Corporate Beneficiaries (Australia)

What Is a corporate beneficiary?

A company that receive a distribution from a discretionary trust.

Why use the corporate beneficiary?

The reasons for a corporate beneficiary include:

- For business owners who want to build a nest egg for their family;

- For business owners coming up to retirement or selling their business, and no longer earning as much business income moving forward.

The idea of a corporate beneficiary is that they take ‘excess’ profits, after distributing a reasonable amount to cover the cost of living to the people within a family group.

So if we’ve got a trust that’s earned $300k in profit, we need to allocate that to people or entities within a family group.

Now it makes sense to take eligible people up to $37k in income. That means we’ve taken them up to 19% tax on their income, and every dollar over $37k (but under $87k) they pay 32.5% tax. (See the table below)

Compare that to a company, where it would only pay 27.5% ( i.e. companies with a turnover of $2million).

The cash needs to follow the distribution. Otherwise we raise Division 7A issues and the ATO doesn’t like ‘on paper’ distributions without the intention of ever paying them. More on that later.

If you distribute to a company, then the company itself will have a tax bill. So you’ll have to pay at least 30% of whatever you distribute to it as a tax payment.

But now we’re left with some money in the company, so how do we get the money out?

Well there’s two ways to do it:

A. Loan from the company

B. Pay dividends to the shareholders from the company

A. Loan from the company

These loans are called ‘Division 7A loans’ and are complex if not treated correctly, but can be used effectively.

These loan agreements typically require that:

- Loan has a maximum term of 7 years;

- That minimum annual repayments be made; and

- That interest is payable at a commercial rate set by government.

You loan money from the corporate beneficiary, and have to pay principal and interest repayments. If your loan is unsecured, you have 7 years to pay back the cash. If your loan is secured (via a property) then you have 30 years to pay back the cash. The interest rate is set each financial year by the RBA, which is usually (5-7%)

So it’s kind of treating your company as a finance lender.

This strategy can be very effective for loaning your 20% deposit for a house or property, then the 80% difference from an actual bank. That way (if secured) you get 30 years to pay back the loan to your own company.

B. Pay dividends to the shareholders from the company

The second way to get money out of a corporate beneficiary is through paying a dividend to the shareholders of the company. The shareholders are who ‘own’ the shares in the company.

Now when we pay a dividend, the shareholders get taxed on that dividend, but they receive a ‘franking credit’ for the tax that the company has already paid.

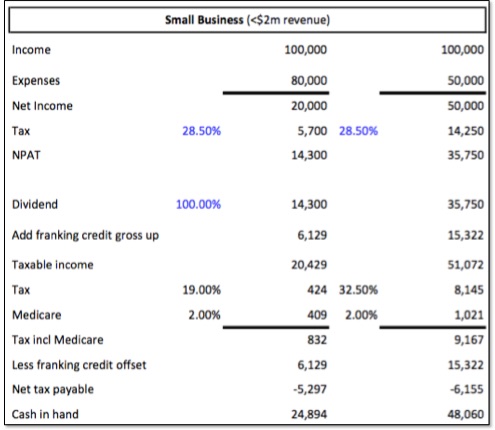

The company has paid 30% tax on their income, or 30 cents for each dollar it earned. When the company pays dividends, the shareholder is taxed on the full amount of the dividend (or profit the company has already paid tax on).

But the franking credit offsets the tax bill for the shareholder. For instance, if the shareholder will pay on average 34.5% in tax on the dividend they receive, they get a 30% franking credit, only having to pay ‘top up tax’ of 4.5% on the dividend they received.

See the table below on how franking credits reduces your taxable income.

So you should always consider the tax impact of paying that dividend.

And MORE importantly, you must consider who the shareholders are of the corporate beneficiary

If they are individuals, then you can only distribute to those individuals (in the % of shares that each of them own).

The best thing to own the shares in a corporate beneficiary is actually another, separate discretionary trust.

That means when we pay the dividends from the company, they fall to the asset trust, then the trustees of the asset trust can allocate the dividends to the family members who pay the least amount of tax. You retain ultimate flexibility.

In summary, getting the money out is not straight forward so ensure you get the best independent tax advice is critical.

Contact Michael to discuss your situation

Confused? Yes it can be complicated. This info is also general in nature - it's not personal tax advice. If you would like personal advice, please don't hesitate to contact our tax expert, Michael Budnow.