Dividends from your startup company … and franking credits (Australia)

Describes what the process is for issue dividends from your startup company, and how franking credits work

Dividends

When companies make a profit, they can elect to pay out some or all of the dividends to shareholders from after tax profits.

The company must:

- Hold a board meeting and prepare and approve a shareholder dividend resolution. Note that the this resolution needs to be declared, ie made / dated prior to the end of the financial year to be included in that financial year, but can be paid after the end of the financial year.

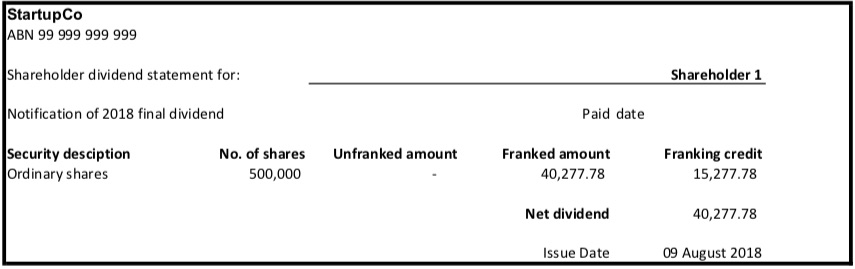

- Issue a dividend statement to each shareholder like this sample

Standard Ledger Dividend and Franking Credit caculator

In our dividend and franking credit calculator we have included built in templates for the board resolution, and the dividend statements that need to be issued.

Access the dividend and franking credit calculator template here

Franking Credits

What are franking credits?

The franking credit (also known as imputation credit) system is designed to avoid double taxation so that where a company has already paid tax on it’s profit’s that this is recognised in the tax return of the individual that receives the dividend so that they are not taxed again.

How do franking credits work?

When dividends are declared in the dividend statement, they are identified as franked (ie the tax has been paid) or unfranked, so that they can be treated appropriately in the shareholder’s tax return.

The franking credit “attached” to a franked dividend reduces the amount of tax to be paid by the investor. In simple terms, the shareholder is allowed to claim the imputation credit as a tax rebate.

Note that each companies can only “pass on” franking credits to shareholders to the extent that it has paid tax. Therefore as part of declaring dividends, and to the extent that are franked or not you need to look at how much tax you’ve paid so that (as part of the board resolution) you can declare whether the dividends are 100% (ie fully) franked, or some lesser percentage dependent on the tax paid. Companies typically track a franking credit account, similar to the example show on the ATO website.

Give me an example

(follows on from the example shown in our Tax Calculator blog)

Let’s talk about Bella (who’s married to Tom) and Barry (who’s in a de facto relationship with Maz). Bella and Barry are 60/40 shareholders in StartupCo. They each hold their shares in family trusts – the BT Trust and the BM Trust.

Tom stays at home with the family and earns $18k through some handyman work.

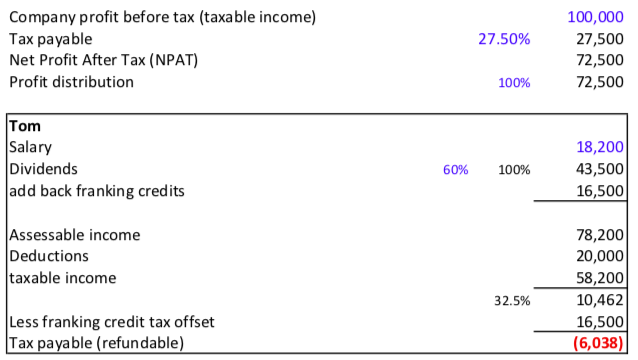

StartupCo looks like it’s going to make a $100k profit for the year. The company will pay $27.5k company tax (at the rate of 27.5%) and decides to issue (100% of) the after-tax profit of $72.5k as dividends to the BT and BM trusts. The BT Trust (as 60% shareholder) receives 60% of this, ie $43.5k. Bella and Tom between them decide that the BT Trust will give all its dividends to Tom, since he will pay a lower income tax rate on them through his personal tax return.

In Tom’s personal tax return he declares his earned income ($18k) + the dividends of $43.5k. This is then adjusted by allowing for the franking credits associated with the original tax paid by the company so that Tom in fact receives a refund of $6,038.

In numbers it looks like this, and you can also download our franking credit calculator to look at your own circumstances.

Franking credits and super funds

(Warning: the below gets pretty technical and you should get proper advice before putting any of this in place)

Where things get really interesting is for vehicles paying less than 30% tax, such as superannuation funds. People often wonder how they can better diversify their superannuation, or how they can derive greater benefits from the tax structure of super funds.

Well, franking credits are one such way. And so setting up a self-managed super fund (SMSF) and investing in companies paying high fully-franked dividends makes sense.

To use the above example, but for a super fund paying 15% tax, not an investor paying 30% tax, consider the following. So company XYZ earns $1000, it is taxed $300, leaving it with $700 in post tax earnings. The super fund now receives the $700 as a dividend (as before), but also receives $300 worth of franking credits (the amount already paid in tax by the company). As mentioned, the amount of tax that must be paid by the super fund is calculated on the gross value of the dividend, which is the cash value of the dividend ($700) plus the value of the franking credits ($300). This gross value is $1000, and so the super fund on a tax rate of 15% is taxed $150. So the fund has a tax liability of $150, but franking credits of $300 too. These franking credits offset the tax owed, and then some.

Not only is no tax owed, but the super fund gets a $150 tax rebate! So the super fund winds up with $850 of the original $1000 in earnings.

Franking credits are so attractive that there is a condition surrounding the benefits they confer on investors. If you have less than $5000 of franking credits annually, then you need only hold the stock for one day if you choose and you still receive the franking credits. However, should you have more than $5000 in franking credits over the course of the year, you must hold the shares for at least 45 days to claim the franking credits on dividends receive.

More information

How does a company pay dividends? [ATO website]

Your franking tax offset in your personal tax return [ATO website]

The dividend statement [ATO website]

Franking credit account [ATO website]