Electronically signing (e-Signing) your tax / BAS returns (Australia)

Standard Ledger uses electronic signatures for your approval for us to lodge Business Activity Statements (BAS'), Instalment Activity Statements (IAS') and income tax returns on your behalf.

We use Xero's Adobe e-sign to securely and electronically record your authorising signature for a number of reasons:

- Adobe Document Cloud is a global leader in secure e-signature and cloud document storage

- Adobe eSign includes a full audit trail of when and who signed

- eSign signatures are compliant with the ATO

- Doing everything electronically is good for the environment

- You can always access the electronic version of the final signed copy of your tax return if you need it in future.

How does it work?

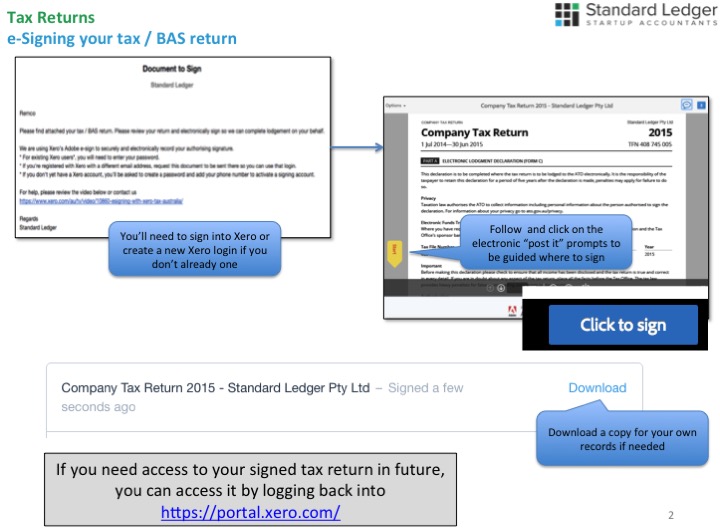

When we've completed your tax return, we'll send you an email notifying you that it's ready for your (electronic) signature.

- For existing Xero users, you will need to enter your password.

- If you're registered with Xero with a different email address, request this document to be sent there so you can use that login.

- If you don't yet have a Xero account, you'll be asked to create a password and add your phone number to activate a signing account.

Please refer to Xero's help for further information on how to:

- E-sign your tax documents

- Decline a request to e-sign a tax return

- View the audit report of the document you e-signed

or you can always contact your service manager.

Note: If in future, you need to access your signed tax return you can access this by logging back into https://portal.xero.com/

Note: It is your responsibility to monitor and pay the ATO any amounts that may be owing. To pay any amounts payable please refer to the ATO payment options (incl EFT Codes, BPAY) which are shown via your tax portal (https://portal.xero.com/) when we ask you to electronically sign your BAS to approve final lodgement.

More information

- Xero help on e-sign'ing, declining or viewing audit trail [Xero help]

- Introduction to electronic signatures incl video [Xero website]

- ATO advice on electronic signatures [ATO website]