How does GST and VAT work?

Explains how you collect GST / VAT on sales, and offset it against GST / VAT you pay on purchases

In Australia, they use Goods and Services Tax (GST) applied to sales and purchases. In the UK, they use Value Aded Tax (VAT) applied to sales and purchases. Broadly the mechanisms are the same in how they work

One of the questions we get asked by new business owner's coming to grips with GST and VAT is how does it thing work?

"If on the sales side I'm charging GST / VAT ... and receive it, then on the other expense side I pay a bill that has GST / VAT in it" do I only pay the difference to the ATO / HMRC (once a quarter via the AU Business Activity Statement [BAS] / UK VAT Return?)"

Short answer is .. yes.

This means that if you're a startup and you are in pre-sales mode - ie head down in development and/or early marketing activities and pretty well just spending money, then this means that you're making losses. As you're mostly just incurring expenses at this stage, you'll be paying GST / VAT but not collecting much (because you're not selling much). Therefore, if you are registered for GST / VAT, you will be able to (via your BAS / VAT Return) claim all the expenses and the related GST / VAT and get the GST / VAT back from the ATO / HMRC ... as cash. This is why we recommend that startups should register for GST / VAT up front even if they don't pass the GST / VAT threshhold when you're required to regiyter.

In Australia, you are required to register when you pass the $75,000 income threshold.

In the UK, you are required to register when you pass the £90,000 turnover threshold

Oh, and if you're in this situation, and you're doing some innovative (research &) development you can also be getting back 43.5% of your R&D (AU) 33% of your R&D (UK) ... as cash, so talk to us more about the this if we can help.

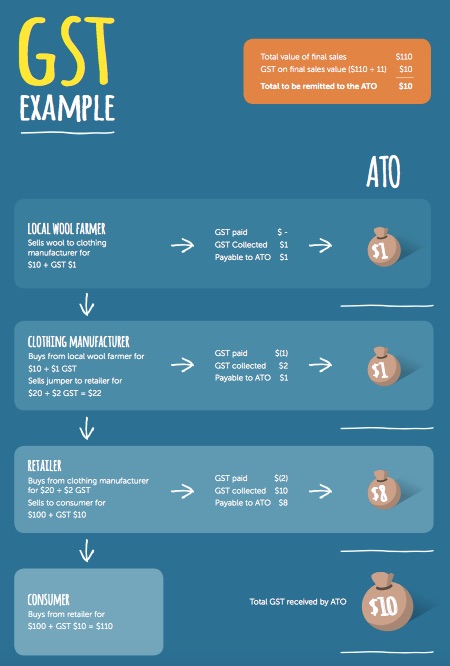

And as a picture often helps, this illustration courtesy of the ATO may also help.

It's relevant to both AU/UK

More information

Australia / ATO- Do I need to register for GST? [ATO website]

- Tax basics for small business video series [ATO website]

UK / HMRC

- Register for VAT [HMRC website]