This information is relevant for clients that are receiving the Accounts Payable service in addition to bookkeeping services.

This is typically at the point where there is enough certainty about the cash position of your company where there is enough cash regularly available to pay the incoming bills as and when they are due.

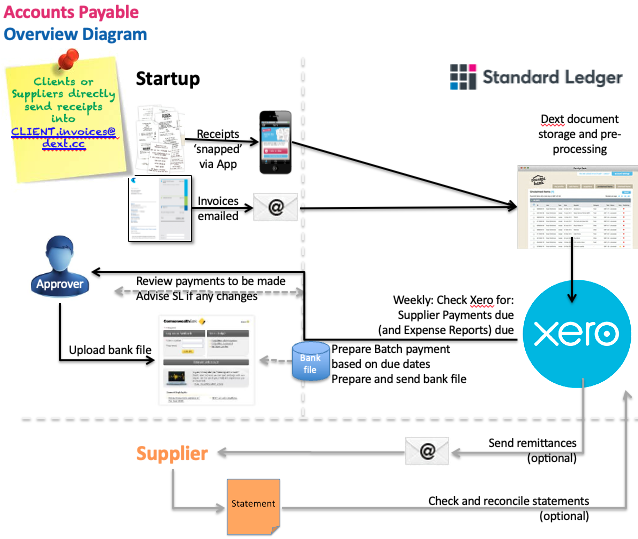

Clients (or suppliers directly) send in bills to be paid to CLIENT.invoices@dext.cc

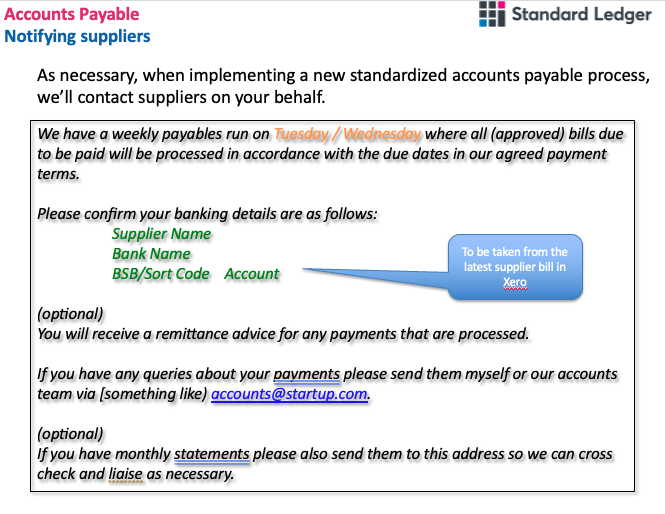

Suppliers should have a dedicated email for any email payment queries, eg accounts@startup.com … which is then either monitored by the Standard Ledger team (ie we login to the accounts@ email to provide first response to all supplier queries.

Setup:

- All suppliers to be paid electronically will need to be reviewed, and their bank details confirmed.

- The protocol for dealing with supplier queries also needs to be agreed

As part of each weekly bookkeeping:

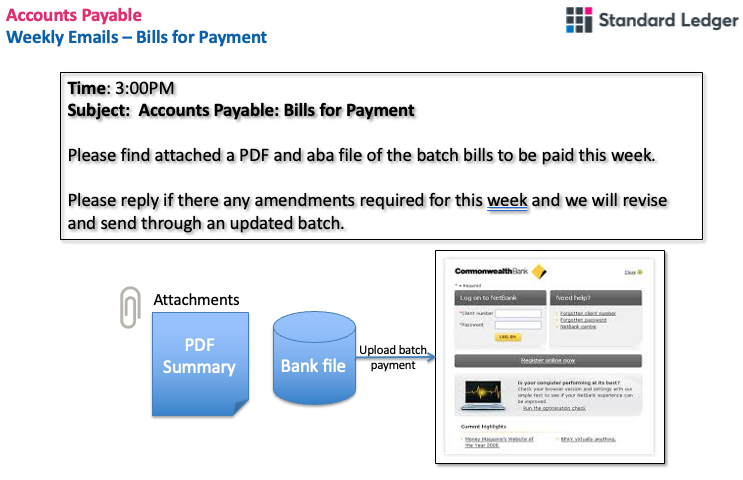

- Bills to be Paid will be reviewed by Standard Ledger, and a batch payment for any payments that are due (according to the due date of the bill) will be sent to to nominated AP payment approver at the client.

- The client AP payment approver will receive a PDF + a bank file to load up to the bank for payment processing. This payment email will be sent through by no later 3pm on the agreed processing day

- If there any payments included in the batch that are not to be included please reply with details of any deletions, revised payment date and/or any other matters, and we'll adjust accordingly.

- If we don’t hear back to contrary we will assume the payment has been made, and will in any case see this has been processed via the bank reconciliation included in our regular bookkeeping

Optional Services

Standard Ledger is able to support you further by providing these services:

- Sending (payment) remittances to suppliers when paid

- Cross-checking supplier statements when they come in (useful in higher volume business) … along with supplier liaison and follow up for discrepancies (typically missing invoices)

- First responder to supplier queries, however: We need to agree a protocol for supplier interaction and in particular managing the “why haven’t I been paid?” queries

Notifying Suppliers

We’ll contact suppliers on your behalf.

Fair use and supplier transaction volumes

When we start providing Accounts Payable processing, we will agree an initial monthly fee based on the specific services required and an agreed estimate of the level of effort involved for the estimated volume of supplier interaction.

As with all our services, we aim to provide a fixed fee estimate that you can rely on each month.

Given the uncertainty associated with the level of supplier interaction, we will monitor the effort required each month.

In line with our Terms and Fair Use policy, should the actual effort required to manage your accounts payable function vary significantly from that originally estimated and agreed we will be in touch to increase your fees to the appropriate level.