We have an R&D Tax Incentive and Grants specialist, who brings more than 15 years' experience to your claim.

Once we’ve engaged with you, we’ll do a kick off call to confirm the scope of your claim and guide you through the process.

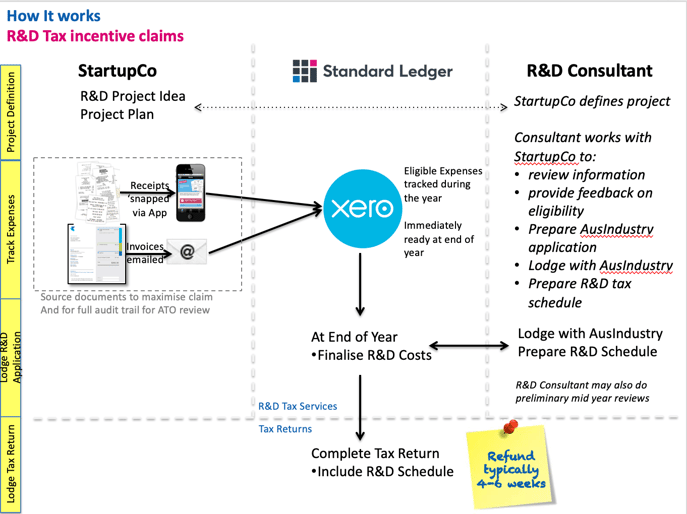

The combination of our R&D expertise and online bookkeeping to track your expenses means you can feel confident about using the R&D Tax Incentive to fund your growth plans.

About the R&D Tax Incentive

The R&D Tax Incentive (RDTI) is a major source of funding for startups and SMEs. It’s an Australian Government program, used by more than 10,000 companies each year. All up, it provides more than $1 billion of support for R&D activities annually.

The RDTI can provide up to 43.5% of your annual R&D costs back through the tax process. In theory, it’s reasonably simple but in practice, there’s a lot to it in terms of eligibility, record keeping and compliance. Head here for our more detailed description.