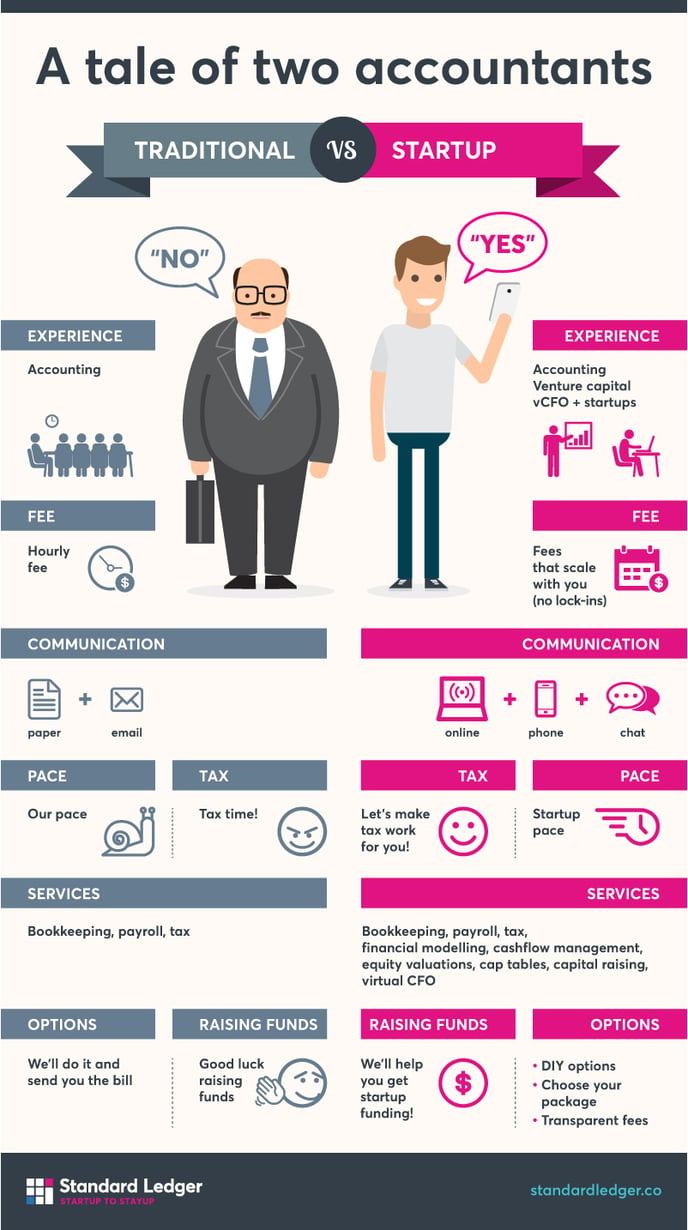

You know what they* say: Once you switch from traditional to startup accountants, you’ll never look back. And check out our blog article on How to choose the right accountant for your startup

For one thing: You’ll enjoy services that scale with you. For another, you’ll be able to access virtual CFO support. And just generally, you’ll benefit hugely from having an accounting partner who actually listens to what you need.

That starts with making it easy to change accountants. Here’s what we’d ask you to do:

- Tell us about any outstanding GST / VAT / tax returns, etc.

- Consider if you want us or your existing accountant to do them (depending on timing)

- Accept our proposal

- As a courtesy, you might want to let your old accountant know. You could also let us know their details so we can get in touch for your previous year’s financials

- Read this list again because you can’t believe how short it is

Really, that’s it. You can make it happen now, by booking a call with us (Australia or UK) to get started.

Which means you can focus on your business, safe in the knowledge that we’ll let you know when stuff is due and we’re ready to help with the bigger stuff like financial modelling, startup valuation and capital raising.

* All the startups who have gone before you and taken the magnificent leap into startup accounting.