One of the things that often comes up is treatment of insurance premiums and the GST component of these ...

If the insurance is paid outright, then the GST / VAT should be as specified on the original invoice/policy documents, no problems.

If the insurance is financed over 12 months, it's a little trickier. Technically you can/should record the original financed amount as a PrePaid expense, claiming the GST / VAT on the insurance premium amount upfront, + recognise the finance charges then reducing / recognising a component of this each month - reducing the PrePaid expense, recognising the insurance expense , the reducing finance component etc ... we do this in some business for bigger financing like vehicles.

Here's the simpler version we're going to do ...

Setup a Repeating Bill for each of the 12 months of the financing period (this will match to the amounts that are withdrawn from the bank account).

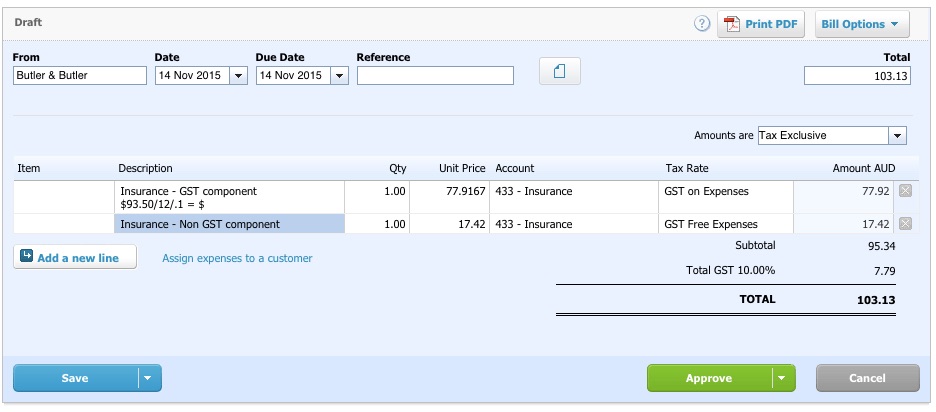

The Repeating Bill has 2 line items:

Insurance - GST / VAT Component .. Grossed up amount for the GST / VAT calculated as follows in this Australian example. it works the same way in the UK at the applicable 20% VAT rate.

- Amount = <GST on original invoice>/12 (months) / .1 (GST)

- Example: If the total amount of GST on the original insurance tax invoice is $93.50, then you would have an amount of $93.50/12/.1 = $77.92

- This is entered with GST on Expenses so you have $7.79 GST / month

Insurance - Non GST component - the balance of the monthly payment, calculated as follows.

- Amount = <Monthly instalment> - <amount above incl GST>

- This is entered as GST Free expense