Treatment by Standard Ledger

When you take out a loan and make repayments, your repayments are actually contributing to a combination of reducing the loan amount (the Principal) and paying for the interest on the loan.

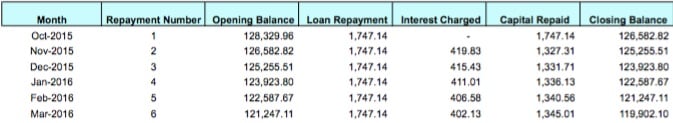

The split of the contribution between these two varies with each payment per the example below. Note this example is a loan repayment schedule typically provided by your lender when the loan is established.

Technically: Once you have recorded the original financed amount as a Loan, each month you would record a varying amount of the interest expense and a reduction in the loan amount (principal reduction) for an up to date loan balance each month. We do this for some larger businesses, but for smaller startups we instead:

- Simply record the monthly repayment as Interest Expense.

- As part of the End of Year tax return process we correctly reflect the split between Interest and Loan balance (we need a copy of the loan documents to help us do this).

This has the effect of overstating the interest expense during the year (ie making the business appear less profitable) and not reflecting the true up-to-date balance of the loan. All of this is brought up-to-date at the end of the year.