- Growth shares grant the holder a share of value increase above a Hurdle Rate. The value is normally some market value plus 10 to 20% as a hurdle

- No Income Tax, NI for either employee or employer on issue

- requires a company valuation when issued. HMRC doesn't approve this, but on sale can investigate the hurdle rate valuation if they want

- there is CGT on disposal, on the amount above the hurdle. Shares are held in escrow until excise

- Unapproved Schemes

- the holder will pay income tax and potentially NI on excise as well as full CGT where capital gain is realised

- company can offset the Gains value of PAYE scheme holders on their Corporation Tax. ie only those on UK payroll who achieve a profit on excise of their options

- EMI Options are the most tax efficient way to grant options to UK employees

- company must have less than 250 employees and £30m gross assets

- the company can't be a subsidairy of another company

- If another company owns > 50% or can otherwise direct, then you also won't qualify

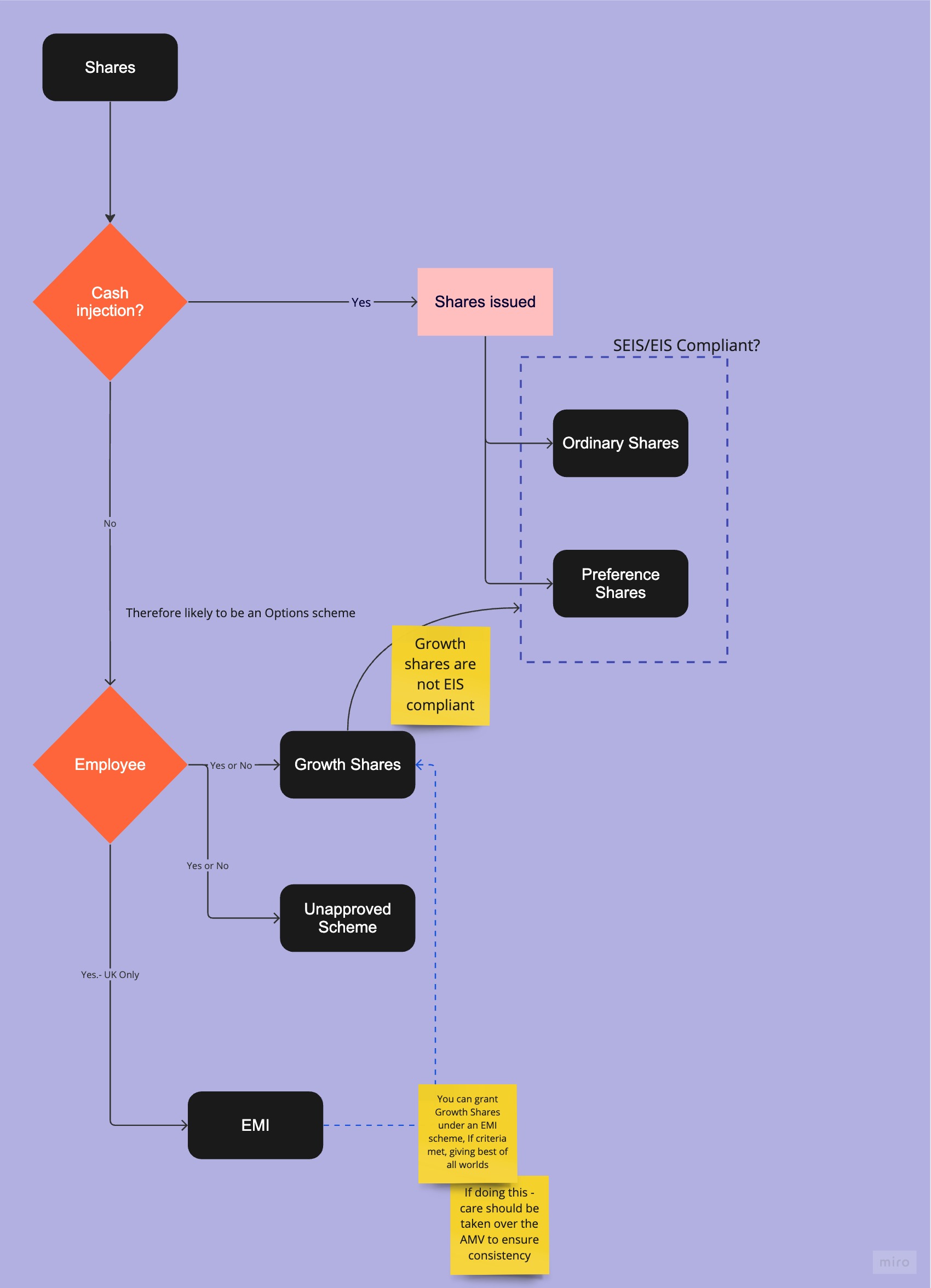

Here's a way to think about this, pictorially: