What is an ESIC? How do I become an ESIC? And what this means for startups raising capital (Australia)

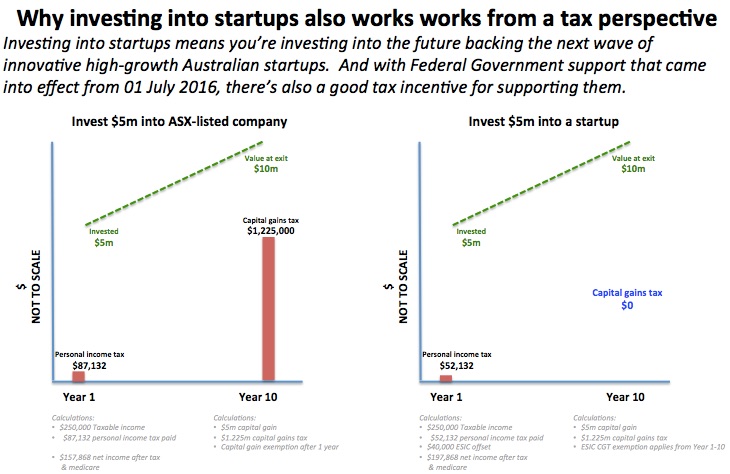

Investors can receive immediate tax offsets and capital gains free investments if your startup is deemed to be an Early Stage Innovation Company (ESIC). Here's everything you need to know.

What is an ESIC? An Early Stage Innovation Company (ESIC) is a company that has started in the last 3 years, has expenses of less than $1 million and has assessable income of less than $200k. It is also involved in innovation.

The offset is capped at $200,000 per year for sophisticated investors and non-sophisticated investors are able to invest up to $50,000 per year on which they can claim the 20% offset for non-sophisticated investors.

This means that if a sophisticated angel investor invests $200k in an ESIC they get a $40k tax offset. This make end of financial year a particularly attractive time to be raising capital.

To make it even more attractive for investors: They get a 10-year exemption from Capital Gains Tax (if they’ve held the shares for at least 12 months). This means that any gains investors make on the sale of these shares will be tax free.

So how do startups "become" an ESIC?

A company will qualify as an ESIC if it meets both:

- the early stage test (<3 years old, expenses<$1 million, income<$200k) AND

- either

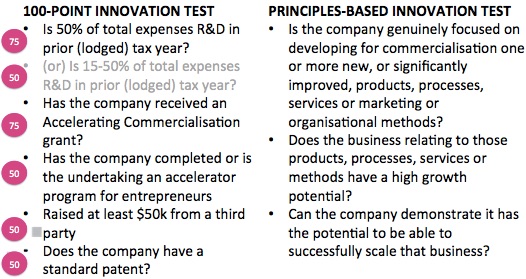

Most companies can make their own determination if they pass the 100-point test which is based on points allocated to whether you're doing a combination of R&D, received an Accelerating Commercialisation grant, in an eligible accelerator (note this cannot include one that is in its first cohort), raised $50k or have patents.

If you don't pass the 100-point test and need to rely on the principles-based test it's a little more subjective and you may need to have an independent outside view of eligibility.

And for certainty for your investors it may also pay to have the ATO provide a pre-approval of your circumstances.

You will also need to inform the ATO of any investors who are availing themselves of the ESIC determination, An ESIC report needs to be submitted to the ATO by 31 July for the prior year.

More information

- Tax incentives for early stage investors [ATO website]

- Qualifying as an early stage investment company [ATO website]

- Accelerating Commercialisation grant [AusIndustry website]