You usually need to send a VAT Return to HMRC every 3 months. Here's how we help you stay up to date.

The deadline for submitting your return online is usually one calendar month and 7 days after the end of an accounting period. This is also the deadline for paying HMRC

If you've engaged with Standard Ledger to prepare your quarterly VAT returns , then in advance of the due dates, we will:

Remind of you of upcoming due dates if we need your help

- for "DIY" clients you need to have completed your reconciliations for the quarter

- for bookkeeping clients we need your answer to any open queries relating to transactions we have been unable to finish reconciling

We send you three (3) reminders

Our process is that we will send you 3 reminders in the weeks up to and including the due date, with the final reminder being sent on the Due Date itself. We will not send you further reminders past the due date.

Past the due date we will periodically re-review outstanding transactions but this cannot be relied on as it is outside of our normal VAT lodgement process. Therefore, if you subsequently obtain the details we have been requesting, please advise us so we can then complete your return as soon as possible.

Review the coding of VAT on transactions for the quarter

- note that if you're a "DIY" client that we're also doing the VAT return for, you have the responsibility for entering /reconciling transactions including the allocation of whether there is VAT on transactions. While we do a high level review of transactions, as we're not involved in your business regularly we may not always be close enough to things to precisely pick up the correct VAT allocation on all transactions.

Once we have prepared your VAT return, in Xero we will:

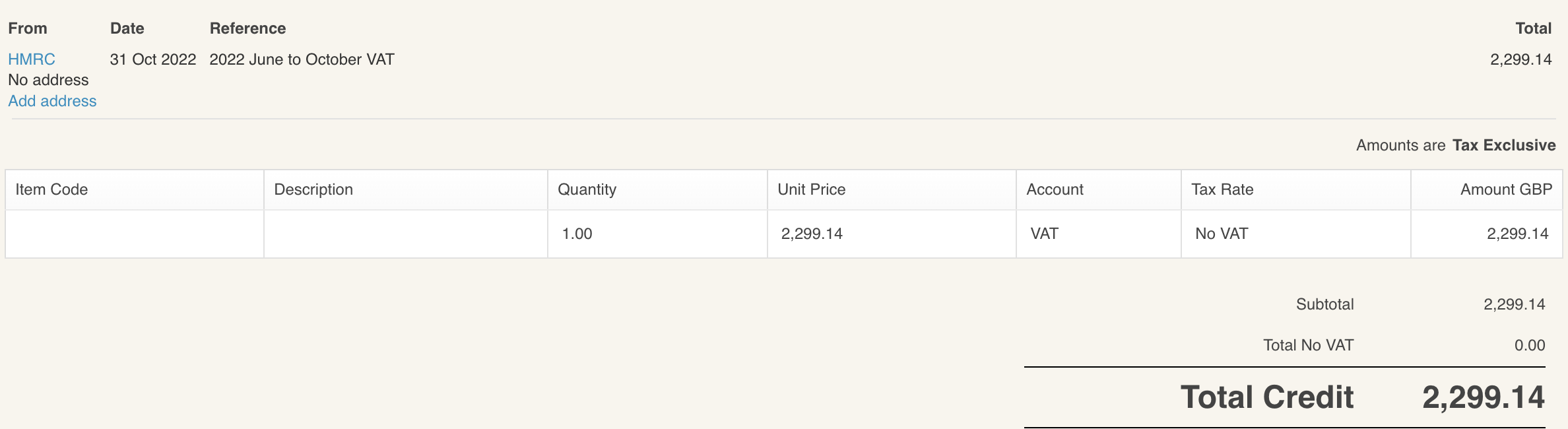

- raise a Bill (with the HMRC supplier) for net payments owing; or

- raise a "sales" invoice (for DIY client) and a "credit note" (for bookkeeping client) (with the HMRC "customer") for net refunds owing.

- these will include line details for for the amount of VAT payable or refund

- to prevent any accidental / retrospective changes in prior period that may affect any submitted VAT returns we will also "lock the period" as at the end of the previous relevant quarter.

- we will send you a request to electronically sign / approve us to lodge on your behalf - this is also your "trigger" / reminder to pay any amounts owing.

Note: It is your responsibility to monitor and pay HMRC any amounts that may be owing, making sure you allow enough time to pay them by the deadline (typically 3 working days). A safe way to remember this is to pay on the last day of the month after the end of the quarter.

You should regard the electronic signature request as a reminder to pay.

More information

- electronically signing your tax / BAS returns [Standard Ledger article]

- Paying your VAT bill [HMRC]