How to manage loans you make to your startup

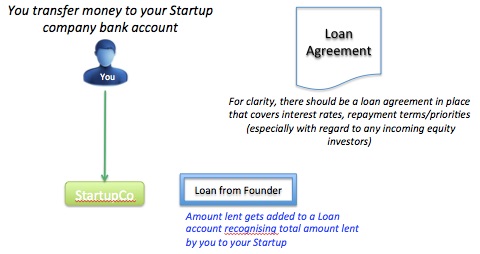

When startups are first starting out, founders often tip in some initial funds to kick things off. These initial funds should be recorded as Loan from Founder so they can be tracked and later paid back (see paying yourself).

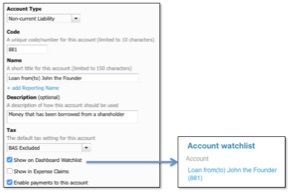

We recommend that you setup an account as a Non-current Liability account, similar to the below, including adding to your Dashboard watchlist as a reminder of the outstanding loan balance.

Note that in this example the loan has been set up as Loan from(to) Founder - amounts lent from the Founder will be shown as a +ve number. In the event that there are (occasionally) amounts lent TO the Founder these would then be shown as a -ve number in the Loan account. We recommend that there be no net loans to Founder at the end of the financial year, as these can be subject to Australian ATO and UK HMRC regulations / scrutiny.

Once the Loan account is setup it can then be used to record receipts of funds into the business (ie a Loan From Founder) or paying back the loan. Note that loan accounts can also be use to record amounts owing to Founders for any expenses they may have incurred on the company's behalf using their own personal external funds/cards etc.

For clarity, there should be a loan agreement in place that covers interest rates, repayment terms/priorities.

Note that the position of loans from Founders can complicate future funding rounds. Investors prefer to see their money growing the business, not going immediately out the door to pay down past debts. Especially if these debts are to insiders, they'll usually expect them to convert the debt into equity rather than be repaid. (eg treating the loan like a convertible note).

Other resources

- The Australian Division 7A clause of the Income Tax Act outlines treatment of any amounts paid to related parties, especially business owners [ATO website]