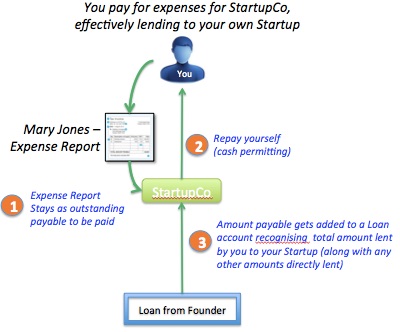

Expenses incurred personally on behalf of your startup

There may be times when Founders or other employees use their own funds or bank accounts to cover company expenses, especially in the early days when just starting out (sometimes before a company even has a bank account of its own).

These expenses should still be financially recorded so that they can, correctly, be deemed a company expense - this can particularly be the case when those expenses paid personally are eligible for R&D Tax claims.

Note that while Xero does have some of its own expense report functionality, we find this is cumbersome and has a restrictive approval mechanism you need to follow.

Instead, setup the employees as a supplier within Xero, calling it something like "Mary Jones - Expense Report". Expenses incurred by Mary ... on behalf of the company ... can then simply be entered as a Supplier Bill, where it can then (potentially) be treated like any other supplier bill for (re-)payment.

Note that you may choose to:

- Leave the Bill sitting there to be paid ... cash permitting

- (re-)Pay the Bill to reimburse the employee ... cash permitting

- Add it onto any Loan Accounts you may have setup as amounts lent to the company from the Founders.

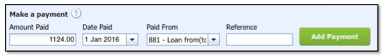

If you want to add the expense onto a Loan Account, once you have entered and saved the expenses onto a Bill, you can choose to "pay" it via the Loan account as follows and the amount of the expenses will then be added onto the loan balance ... to then be managed / repaid along with any other loan amounts. The benefit of this approach is that it puts all the loan amounts to be repaid into one place.

Note that if you're a Receipt Bank user with Standard Ledger, we setup employees to be able to "Snap 'n Send" receipts on their phone or via email, and then take care of creating the employee expense reports and bringing them into Xero so they can be managed / paid back to the employee.