What is the startup concession, what does it mean for my employees, and am I eligible? (Australia)

If your startup is eligible for the startup concession, employees can be issued shares or options without incurring an upfront tax obligation.

Background

Startups often want to incentivize staff to participate in the growth journey and any valuation upside along that journey, through the issue of shares or options in the startup.

In 2015, the ATO (finally) introduced startup concession criteria and legislation whereby employees could receive concessional treatment to receive shares or options in their startup … without having an upfront tax impact. This was introduced by the ATO to allow employees to share the upside. Traditionally where employees have received any benefit that had a value, this benefit would have been taxed. This is good news for startups and their employees and has been a core tenet of the Australian startup ecosystem since 2015.

Options vs Shares

Startups may either:

- choose to issue shares directly to employees - this requires employees to purchase their shares and hence is not as attractive as options. Companies may issue shares at an up to 15% discount off the prevailing market value; or

- (more popularly) issue options that can be exercised to convert into shares. These are popular because they require no cash upfront and typically only exercised in / around a company exit. Option entitlement is typically earned (vested) over a period of 3-4 years.

Eligibility

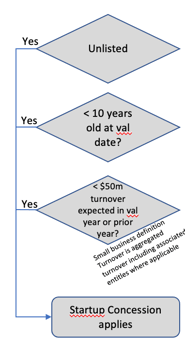

To be eligible for the startup concession, the company must:

- Have been incorporated for less than 10 years;

- Have an aggregated turnover* of less than $50 million; and

- Not be listed on the stock exchange.

In addition, employees must:

- not have 10% or more of the shares / options; and

- hold … or intend to hold … their options or shares for at least 3 years.

* Aggregated turnover determination requires consideration and applies where investors hold greater than 40% or exert significant control. For startups invested into by VCs through controlling shareholder agreements this typically requires formal consideration and tax advice.

Valuation

Where options are issued, startups are often able to set an attractive option exercise price for employees based on a quite discounted Net Tangible Asset (NTA) valuation. See our ESS/ESOP valuation FAQ for more information.

Reporting obligations

Once an ESS/ESOP has been established, companies have an annual reporting obligation to both their employees and to the ATO. See our ESS lodgement FAQ for more information.