How we prepare your tax return (Australia)

If you've engaged with Standard Ledger to prepare your tax return then in advance of the ATO due dates, we will:

- Review all profit and loss and balance sheet transactions for the year.

- If you are doing your own bookkeeping, you are responsible for entering, reconciling and allocating transactions. We only do a high level review of these allocations on your profit & loss and balance sheet, so please ensure these are allocated before we prepare your tax return.

- We may need to prepare end of year adjustment journals to correctly reflect balance sheet and profit and loss, eg for depreciation, and we will always seek confirmation about any adjustments.

- In Xero we try to align the accounts in Xero to reflect the company tax return. This may include:

- providing reconciling items from the ATO Portal to your tax balances in your company tax return;

- providing the amount of GST (payable or refund) and/or employee PAYG payable and/or any relevant PAYG income tax instalments payment, as well as any rounding to reflect the whole dollar amount payable to the ATO.

- We will provide a tax reconciliation of adjustments we’ve made between your Xero accounts and the tax return, if any.

- We will also provide you an estimate of tax payable or refundable amount.

In Xero we will then either:

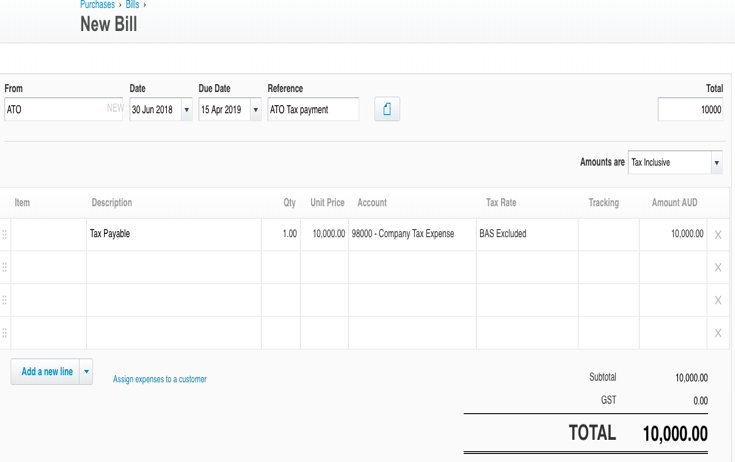

- raise a Bill (with the ATO supplier) for net payments owing; or

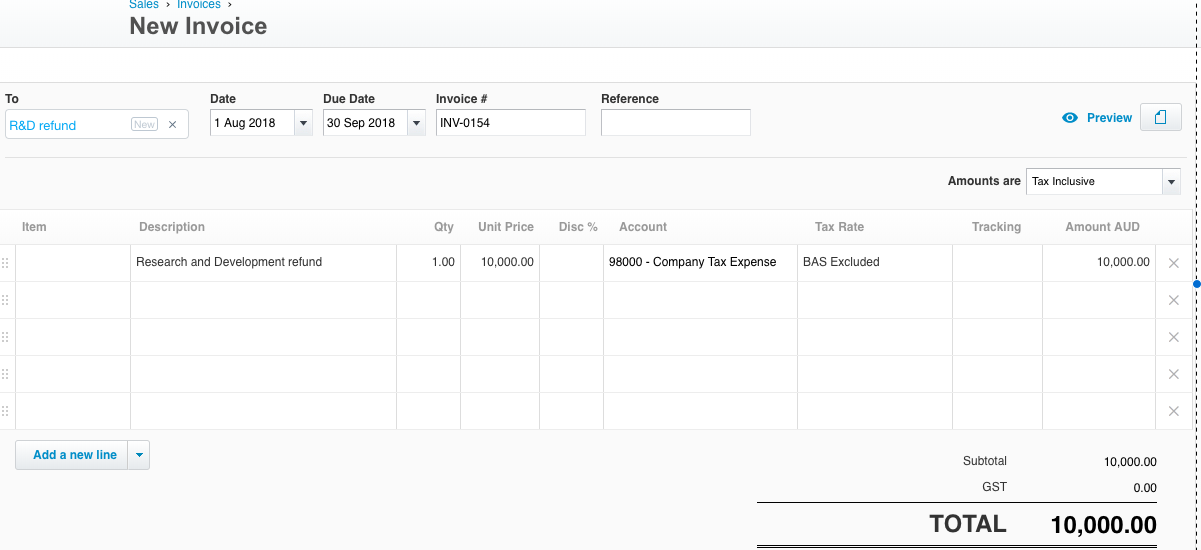

- raise a "sales" invoice (with the ATO "customer") for net refunds owing (eg for an R&D refund)

- these will include line details for for the amount of tax (payable or refund) as well as any rounding to reflect the whole dollar amount payable to the ATO

Tax Payable Bill (example)

Tax Refund receivable "invoice" (example)

You need to electronically sign your tax return for us to lodge

- Once we’ve prepared the return for completion we will send the tax return to you for review and to electronically sign / approve us to lodge on your behalf - this is also your "trigger" / reminder to pay any amounts owing.

- Once signed we will then lodge with the ATO or in some cases, if instructed, delay the lodgement until the 15May due date.

Special Purpose Financial Report (SPFR)

When we prepare your tax return we will also prepare a Special Purpose Financial Report (SPFR) (sometimes known as your "Financial Statements", or you may even hear accountants refer to this as a Compilation Report)

- These reports are compliant with Chartered Accountants Australia and New Zealand Special Purpose Financial Reporting (CAANZ SPFR), and Certified Practising Accountants in Australia.

- The SPFR is prepared for the purposes of sending them out to decision makers (owners, financier etc) and taxation authorities.

- We prepare the SPFR so decision makers have a full and accurate description of the activities that it has been involved with during the reporting periods presented.

- We can customise the SPFR to your specific needs as well, although additional fees may apply.

- Once finalised, the SPFR is available though the published Reports section within Xero

Note: It is your responsibility to monitor and pay the ATO any amounts that may be owing. You may regard the electronic signature request as a reminder to pay. To pay any amounts payable please refer to the ATO payment options (incl EFT Codes, BPAY) which are shown via your tax portal (https://portal.xero.com/) when we ask you to electronically sign your tax return to approve final lodgement

Note: If in future, you need to access your signed tax return you can access this by logging back into https://portal.xero.com/

More information

- electronically signing your tax / BAS returns [Standard Ledger article]

- How do I pay my tax return [Standard Ledger article]