What are the key due dates I need to be aware of for lodgement? (Australia)

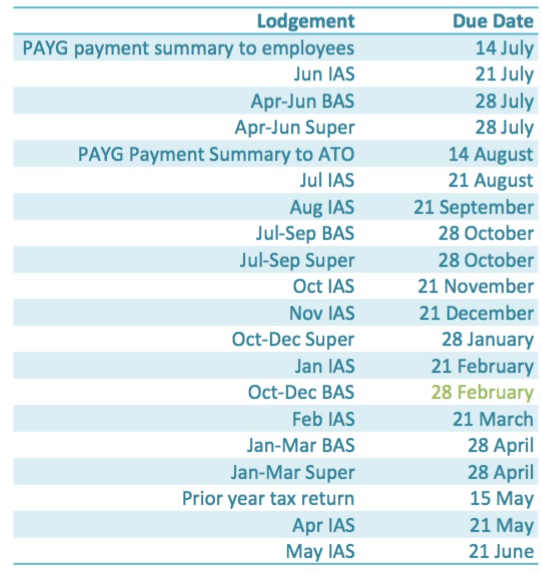

See below and the Australian Tax Offices full list of due dates. The key dates to be aware of are shown below. Note that you can conveniently also add this to your own Google Calendar by following this Key Lodgements Calendar (AU) link

When is my tax return due?

For the 30Jun end of financial year (EOFY) lodgement is due by 15May the following year

eg 30Jun18 is due 15May19

Note: if you're due a tax refund (eg with a R&D tax incentive) we prioritise handling of these returns as soon as possible after the end of the financial year, once your R&D is ready so you get your refund sooner :)

Note: The tax office can deem and notify companies that they should be paying something (known as PAYG instalments) towards the estimated end of year tax payable. When notified, this is included in our quarterly BAS preparations.

See How we prepare your tax return for more information

When is my BAS (Business Activity Statement) due?

Quarterly Business Activity Statement (BAS) for Goods & Services taxes lodged and (net GST) payment (or refund) due 28th of the month after

eg Jul-Sep BAS is due 28Oct

See How we prepare your BAS for more information

What are the payroll related due dates?

If/when you're doing payroll it's a whole another level:

- Quarterly PAYG Withholding (taxes taken out of employee pay and due to the ATO) is handled with the quarterly BAS' above until you're at about a A$100k salary level then you're required to lodge a monthly Instalment Activity Statement (IAS) monthly between the quarterly BAS', due the 21st after the end of month

eg Jul IAS is due 21Aug

- Quarterly superannuation is due on the 28th of the month after

- Statements to Employee at EOFY are due 14Jul (after EOFY) and employer lodgements are due 14Aug

- At around $47k/month salary you're also up for state based payroll taxes.

See Payroll: Information for Employers for more information

Confused? We've got it covered ...

As part of our Bookkeeping, BAS and payroll services, we proactively manage all these dates and reach out as and when they're due. If we've previously helped you prepare and lodge your tax returns we'll also remind you when these are able or due to be prepared.

What happens if a due date is missed?

The ATO can and does apply penalties if you fail to lodge on time (hence why we send three reminders). Occasional lapses are typically but not always ignored.

Penalties are applied at the rate of $210 per every 28 days past the due date.

More

- Full list of ATO due dates [ATO website]

- Failure to lodge penalties [ATO website]

- How we prepare your BAS [Standard Ledger FAQ]

- How does GST work? [Standard Ledger FAQ]

- How does PAYG withholding work? [Standard Ledger FAQ]

- PAYG income tax instalments [Standard Ledger FAQ]