This is how we go about our job of reconciling bank transactions each week

Each week, as part of our weekly bookkeeping as big part of our service is to do the bank reconciliation. This involves:

- matching receipts to invoices raised;

- matching payments to supplier bills you've sent into Dext (formerly Receipt Bank);

- reconciling other transactions that we understand and have agreed their treatment with you (see below);

- raising questions about any transactions we're not clear on; and

- any other specific processing we have agreed as part of your service

Reconciling transactions without invoices

See the When do I need receipts FAQ.

| Australia / ATO | Per the ATO you are required to have a receipt for any transactions of more than $82.50 (including GST) in order to claim a GST credit. Below this, a confirmed bank transaction (eg a Xero bank feed) is OK as proof of the transaction as long as we're comfortable with the GST treatment. |

| UK / HMRC | Per HMRC, you are required to keep a record of everything you buy and sell |

Pragmatically, and in order to keep on top of the flow of transactions, we can and do reconcile transactions without an invoice, where clients are OK with this - remember that it is your obligation to be able to provide a valid invoice to the ATO or HMRC upon request or audit.

A very common example we see of this practical approach is for flights - the itineraries are typically emailed (and so are available to show the ATO/HMRC if needed). While it is easy and still good practice to send invoices into Dext (by simply forwarding the itinerary email) practically for some clients we have agreed to simply auto code these to Travel without an invoice.

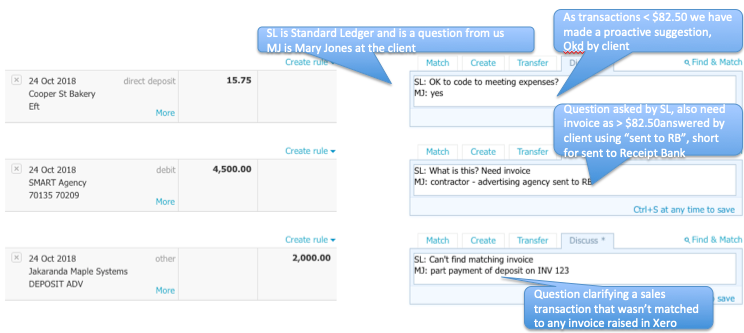

If we see a transaction without a matching invoice, we will use Xero discuss to raise a question about it (see below). This is how you can instruct us on any "standing instruction" treatment going forward per the example above.

Feel free to also tell us (something like):

Standing instruction: Always code Telstra transactions straight to Telephone… because I never get “Frank” to find them in his email

Handy hint too: You can set up Filters in Gmail to auto-forward to your Dext email

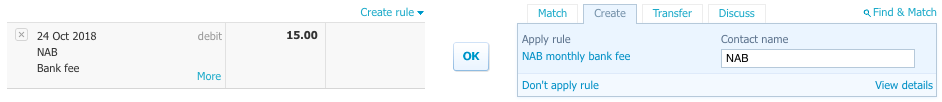

Bank Rules

Where it's been agreed that certain transactions will be treated in a certain way (eg code all Uber's to travel), we typically set up a bank rule in Xero to ensure consistent treatment as agreed. You'll see where these are in place like this:

Raising questions about any transactions

Where we are unsure about the treatment of any particular transaction in your bank account, we use the Discuss tab within Xero to ask for clarification. We find this method works best as it lets your see the transaction in situ.

As part of your own regular checking of Xero we ask that you check for any of our queries and reply within the Xero discuss tab.

Examples of this are below. We try and keep the format of our queries simple, consistent and to the point, eg a simple "What is this?" when we don't know.

Australia / ATO

UK / HMRC